FundBank: As we look back at the first half of 2025, it has been an extremely active and successful year so far for FundBank*, as we continue to deliver banking solutions to the alternative asset management industry on a global scale. Read more….

Member News

May 19, 2025

Forvis Mazars: Economic and market progress stalled in the first quarter, as higher-than-expected tariffs and inconsistent implementation created concerns for investors. After a strong start, U.S. stocks fell during the quarter. Learn more…

May 19, 2025

Forvis Mazars: FASB standard setting in the first quarter slowed considerably after a record-setting fourth quarter 2024. FASB issued only one Accounting Standards Update (ASU), with a minor correction to the implementation date of ASU 2024-03 on expense disaggregation and two narrow exposure drafts on debt exchange and codification improvements. Learn more…

May 19, 2025

Forvis Mazars: This paper provides an overview of recent standard-setting activity by the SEC’s Division of Investment Management, reminders on newly effective rules, updates on the SEC’s regulatory agenda, recent enforcement actions, and exam priorities. Learn more…

April 4, 2025

Forvis Mazars: With today’s shifting global trade policies, tariffs have become a hot topic for businesses of all sizes. While traditionally seen as a cost directly impacting importers, tariffs can have far-reaching implications, influencing everything from supply chains to tax strategies. Learn more…

February 26, 2025

The Miami Downtown Development Authority is fueling Downtown Miami’s economic boom by offering grants to businesses relocating or expanding within its vibrant districts. Grants are available for ground-floor retail and mid-sized businesses. Additionally, start-up companies can compete for a grant at our yearly pitch competition. Download PDF…

January 30, 2025

Today, FundBank Group announced that the European Central Bank issued an authorisation on 16 December 2024, allowing FundBank (Europe) S.A. to take up the business of a credit institution under the Luxembourg act of 5 April 1993 on the financial sector, as amended. Read more…

January 13, 2025

Forvis Mazars: This paper provides an overview of recent standard-setting activity by the SEC’s Division of Investment Management, reminders on newly effective rules, updates on the SEC’s regulatory agenda, recent enforcement actions, and exam priorities. Read more…

January 6, 2025

Forvis Mazars: To address unforeseen events and unexpected changes affecting their business, owners should consider having an ownership—or buy-sell—agreement to help mitigate a variety of risks. However, the execution and maintenance of these agreements can sometimes be an afterthought for owners, leading to ownership disputes that can result in costly litigation. Read more…

November 21, 2024

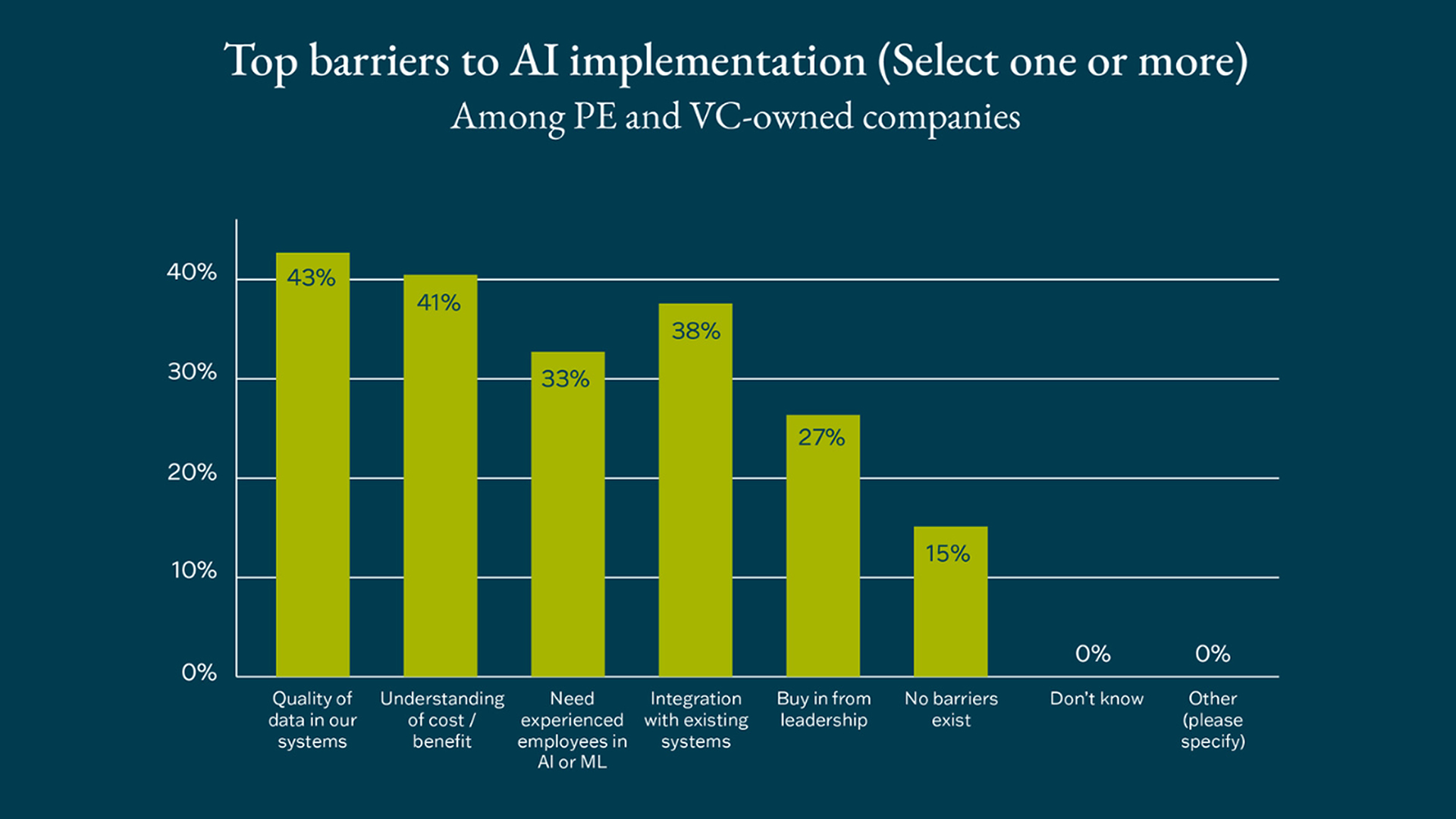

Citrin Cooperman: The market may look great in terms of committed capital but much remains dysfunctional. The story varies widely based on sector and by type of fund — things look very different to emerging managers and independent sponsors. The historically low levels of deals, despite 1.5x as much dry powder as six years ago, also suggests something will have to give. Read more…

November 21, 2024

FundBank, National Association (“FundBank, N.A.”) announced today that it has been approved by the U.S. Department of the Treasury’s Office of the Comptroller of the Currency to operate a national bank. FundBank, N.A. is headquartered in Austin, Texas, with a relationship management office in New York City, NY. The bank will commence operations with a limited number of initial clients and plans to fully open in mid-December. Read more…

October 31, 2024

Forvis Mazars: On October 21, 2024, the SEC’s Division of Examinations issued its 2025 Examination Priorities that support its stated mission—promote compliance, prevent fraud, monitor risk, and inform policy. The group will continue its focus on compliance, governance practices, and cybersecurity. Download the PDF below to see what investment advisers, investment companies, and broker-dealers need to know to prepare for upcoming exams. Read more…